Understanding Money and Income

Category:

4

out of 5

4

6 reviews

This free online Financial Literacy course will teach you a range tricks and techniques which you can use to help manage your finances better. Poor personal finance management can severely affect your life and credit rating. This course will teach you about saving money, budgeting for college, dealing with debt, financial aid and monthly planning.

Main Features

- Save money

- Learn how to apply for financial aid

- Privatized loans vs Federal loans

- Monthly saving goals

- Scholarships, grants

- How to learn healthy spending habits

What is the target audience?

Gaining financial literacy is empowering, although as a complete beginner is very intimidating. There are a lot of tutorials, documentation and advice already out but how do you start and proceed with learning. This resource is the place for student athletes to began their financial independence.

-

The Basics of Money

- Money is more than just cash; it's a tool for trade, savings, and future planning.

- We'll dive into different forms of income: wages, salaries, bonuses, and stipends.

- Understanding your income is the first step towards effective financial management.

-

Decoding Your First Paycheck

- Excited about your first paycheck? Let's understand its components.

- Gross pay vs. Net pay: What's the difference?

- Breaking down deductions: Taxes, Social Security, and other withholdings.

-

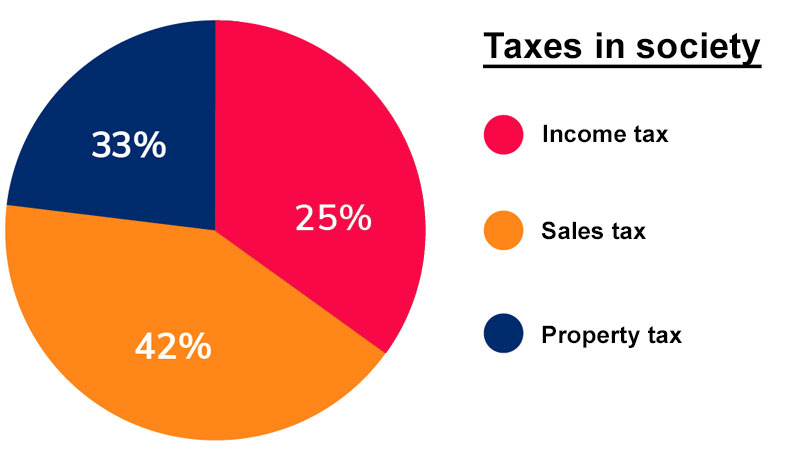

Taxes Explained

- Why do we pay taxes? Understanding the role of taxes in society.

- Different types of taxes: Income tax, Sales tax, Property tax

- Simple tips for tax planning and preparation.

Quiz Questions:

- What is the difference between gross pay and net pay?

- Name two types of deductions commonly found on a paycheck.

- Explain the purpose of taxes in society.

Enrolled:

136 students

Duration:

10 minutes

Video:

0 hours

Level:

Beginner